img width="407" src=" ">

">

p>Swing Trading: A Forex Strategy for Intermediate Traders</p>

p>Welcome to the world of swing trading, a top strategy that has gained immense popularity among intermediate forex traders. As you continue your journey in the forex market, mastering swing trading can offer you an exciting approach to capturing profitable opportunities.</p>

p>Swing trading strategies for forex success provide traders with the flexibility to capitalize on short-term price movements, aiming to capture the "swings" within larger trends. Unlike day trading, swing trading allows for a more relaxed and less time-consuming trading style, making it an attractive option for those with a busy schedule.</p>

p>To optimize your swing trading in the forex market, it's crucial to understand the key differences between swing trading and day trading. While day trading involves executing multiple trades within a single day, swing trading focuses on holding positions for longer periods, from a few days to weeks. This longer timeframe allows for a more thorough analysis of market trends and increased potential for substantial profits.</p>

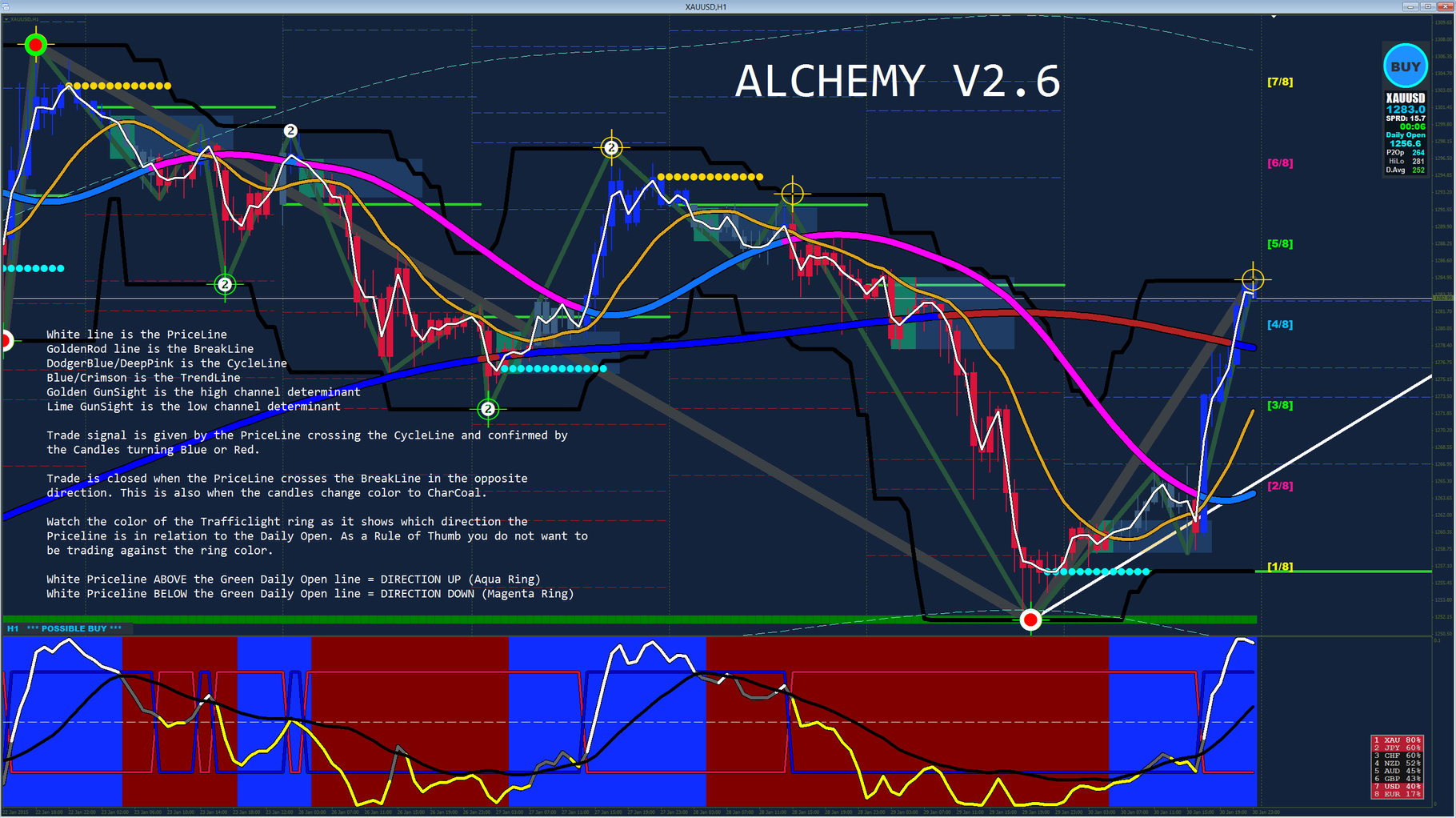

p>Indicators play a vital role in forex swing trading, helping traders identify potential entry and exit points. While there is no one-size-fits-all indicator, some popular choices among swing traders include moving averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD). Combining these indicators with your technical analysis can provide valuable insights into market trends and enhance your decision-making process.</p>

p>Successful swing trading in forex not only requires a keen eye for market patterns but also proper risk management techniques. Remember to set stop-loss orders to protect yourself from significant losses and to implement proper position sizing to ensure you don't risk too much of your capital on a single trade. Consistency in risk management is key to long-term success as a swing trader.</p>

p>Stay tuned for the rest of our article, where we will discuss how to identify swing trading opportunities in forex, backtest your strategies, and explore the emotional discipline required for successful swing trading. Join us on this journey as we uncover the secrets to maximizing profits through swing trading and navigating forex market cycles for intermediate traders like yourself.</p>

h3 id="1-mastering-swing-trading-strategies-for-forex-success">1. Mastering Swing Trading Strategies for Forex Success</h3>

p>In the world of forex trading, swing trading is often considered a top strategy for intermediate traders due to its potential for significant gains. Unlike day trading, which focuses on short-term price movements, swing trading aims to capture larger price swings over a period of days or weeks. By honing your swing trading skills, you can optimize your success in the forex market and take your trading endeavors to the next level.</p>

p>One of the key factors in mastering swing trading is understanding the various strategies that can be employed. These strategies may involve using technical indicators, analyzing key market patterns, or even employing backtesting to refine your approach. By identifying the strategies that resonate with your trading style, you can develop a solid foundation for successful swing trading in the forex market.</p>

iframe src="https://www.youtube.com/embed/IlFnjHJRCOo" width="560" height="315" frameborder="0" allowfullscreen></iframe>

p>Risk management is another crucial aspect of swing trading. When engaging in this strategy, it's essential to set proper stop losses to limit potential losses and protect your capital. By setting these stop losses strategically, you can navigate the inherent volatility of the forex market and minimize the impact of adverse price movements on your trades.</p>

p>To identify swing trading opportunities in forex, keep a close eye on key technical patterns such as support and resistance levels, trend lines, and chart patterns. By recognizing these patterns and understanding their significance, you can time your trades more effectively and maximize your profit potential.</p>

p>Once you have transitioned from a beginner to a swing trader in the forex market, emotional discipline becomes paramount. The ability to control your emotions and stick to your trading plan even during turbulent market cycles is crucial for long-term success. Maintaining a disciplined approach will help you make rational decisions and avoid impulsive actions that could negatively impact your trading results.</p>

p>Mastering swing trading in the forex market requires constant learning, adaptability, and perseverance. By continuously optimizing your strategies, managing risk effectively, and developing emotional discipline, you can maximize profits and capitalize on the cyclical nature of the forex market. With the right mindset and dedication, you can excel as an intermediate trader and achieve success in swing trading.</p>

h3 id="2-optimizing-swing-trading-in-the-forex-market">2. Optimizing Swing Trading in the Forex Market</h3>

p>To succeed in swing trading, intermediate forex traders must focus on optimizing their strategies for the forex market. By tailoring their approach to capitalize on swing trading opportunities, traders can improve their chances of success.</p>

ol>

<li>

p><strong>Identifying Swing Trading Opportunities</strong>: One key aspect of optimizing swing trading in the forex market is the ability to identify suitable opportunities. Intermediate traders should be equipped with a strong understanding of market trends, technical analysis, and key indicators. By keeping a close eye on price patterns and trends, traders can spot potential swing trading setups and capitalize on them.</p>

/li>

<li>

p><strong>Backtesting Swing Trading Strategies</strong>: Backtesting is an essential step in optimizing forex swing trading strategies. Before implementing a strategy, intermediate traders should thoroughly test it using historical data. This allows traders to evaluate the effectiveness of their approach and make any necessary adjustments, ensuring that their strategies are well-suited for the forex market.</p>

/li>

<li>

p><strong>Emotional Discipline and Risk Management</strong>: Emotions can often cloud judgment and lead to poor decision-making. To optimize swing trading in the forex market, intermediate traders must practice emotional discipline and implement effective risk management techniques. This includes setting proper stop losses, managing position sizes, and sticking to their predetermined trading plans. By doing so, traders can protect their capital and maintain a disciplined approach, increasing their chances of long-term success.</p>

/li>

/ol>

p>By optimizing their swing trading strategies in the forex market, intermediate traders can enhance their likelihood of success. Identifying swing trading opportunities, backtesting strategies, and maintaining emotional discipline are all crucial components of optimizing one's approach. With consistent effort and learning, traders can continue to refine and improve their swing trading skills, transitioning from intermediate to advanced levels in the forex market.</p>

h3 id="3-key-technical-patterns-for-forex-swing-trading">3. Key Technical Patterns for Forex Swing Trading</h3>

ol>

<li>

p>Ascending Triangle Pattern:

The ascending triangle pattern is a bullish continuation pattern frequently observed in forex swing trading. It is formed by the convergence of a horizontal resistance line and a rising trendline. Traders often look for this pattern to identify potential buying opportunities. When the price eventually breaks above the resistance line, it signals a potential upward price movement, making it an essential pattern for swing traders to be aware of.</p>

/li>

<li>

p>Double Bottom Pattern:

Another crucial technical pattern for forex swing trading is the double bottom pattern. This pattern forms when the price creates two distinct lows at a similar price level, followed by a breakout above the resistance level. It indicates a potential trend reversal from a downward movement to an upward one. Intermediate traders often use this pattern to find entry points for long positions, capitalizing on potential market upswings.</p>

/li>

<li>

p>Bullish Engulfing Pattern:

The bullish engulfing pattern is a strong bullish reversal pattern seen in forex swing trading. It occurs when a small bearish candlestick is followed by a larger bullish candlestick that completely engulfs the previous candle. This pattern signifies a shift in market sentiment from bearish to bullish, presenting an opportunity for intermediate traders to enter long positions. The bullish engulfing pattern can indicate a potential trend reversal, making it a valuable tool in swing trading strategies.</p>

/li>

/ol>

p>Remember, mastering key technical patterns is vital for successful swing trading in the forex market. By identifying and understanding https://edge-forex.com/essential-hedging-strategies-for-risk-management/ , intermediate traders can improve their ability to spot potential opportunities and make well-informed trading decisions. Keep in mind that technical analysis should be combined with risk management and other indicators to enhance the effectiveness of swing trading strategies.</p>

![[PukiWiki] [PukiWiki]](image/pukiwiki.png)